If you do not have acceptable evidence of ownership for a vehicle you own or have recently purchased, you may have the option of applying for a bonded title. If eligible, the donor and recipient must complete a notarized Motor Vehicle Gift Transfer Affidavit describing the transaction and the relationship between the parties and must be filed in person by either the donor or the recipient. Learn about the Vehicle Inspection Program on the. Texas requires state-registered vehicles to pass an annual inspection to ensure compliance with safety standards. Have your vehicle inspected at a certified inspection station. Effective Sept 1, 2009, the only transactions that qualify to be gifts ($10 sales tax) are those wherein the vehicles are received from a: spouse, parent or stepparent, in-laws, grandparent or grandchild, child or stepchild, sibling, guardian, decedent's estate, or if it is donated to, or given by a nonprofit service organization qualifying under the Internal Revenue Code, Sec. There are several steps to register your vehicle with the Texas Department of Motor Vehicles. House Bill 2654 established new criteria for determining when a transaction qualifies as a gift for motor vehicle tax purposes. Sales tax calculated at 6.25% on the purchase price or the standard presumptive value, whichever is greater.

#CAR TITLE REPLACEMENT TX REGISTRATION#

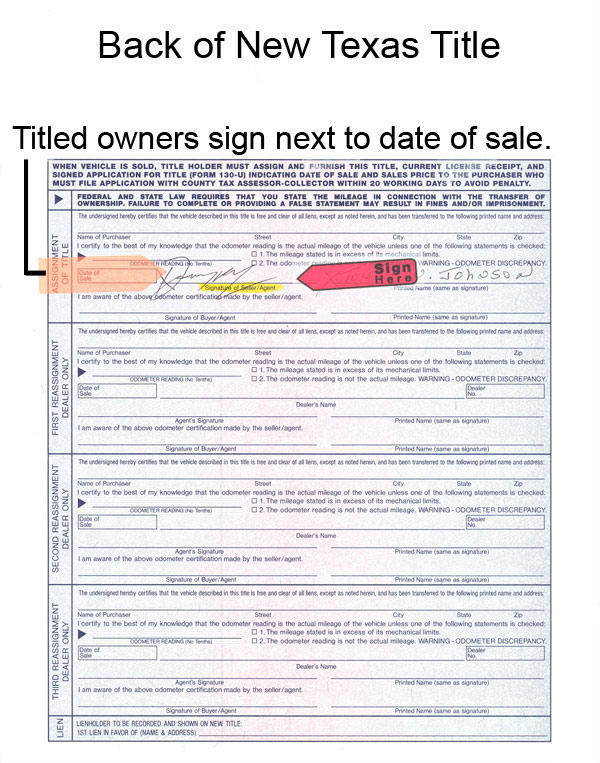

Insurance cannot be in the name of the seller. *If renewing registration during title transfer a recent safety inspection is required Motor vehicle body damage disclosure requirements apply only to the transfer of certificate of title on vehicles less than nine (9) model years old. *An Application for Texas Certificate of Title (Form 130-U) completed by buyer(s). Signatures of all listed owners required. *The original title, properly assigned by seller(s) to buyer(s). The buyer will need to bring the following information: Transfer of ownership must be filed within 30 calendar days to avoid penalties.Īll title transfers require a government issued ID/Passport.

0 kommentar(er)

0 kommentar(er)